nassau county property tax rate 2021

Suffolk County is a fraction more expensive clocking in at an average of 23 of the assessed fair market value. The Countys assessment roll includes over 423000 properties with a value of 264 billion.

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Property Tax in East Nassau NY 2021 Guide Rates Due Date Exemptions Calculator Records Codes.

. Yearly median tax in Nassau County. Learn all about East Nassau real estate tax. FOR IMMEDIATE RELEASE June 1 2021 Contact.

86130 License Road Suite 3. In order to only pay the fair amount its important to know how to calculate how much you owe. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

The New York state sales tax rate is currently 4. Nassau County collects on average 074 of a propertys assessed fair market value as property tax. In 2018 the average amer.

Florida is ranked 18th of the 50 states for property taxes as a percentage of median income. The Nassau County sales tax rate is 425. Home values in Nassau County are soaring to record levels.

The New York state sales tax rate is currently 4. Based on the CPI used for 2021 previously homesteaded properties will see their assessed value increase no more than 14 this year. It is the second largest assessing entity in the.

Download all new york sales tax rates by zip code the nassau county new york sales tax is 863 consisting of 400 new york state sales tax and 463 nassau county local sales taxesthe local sales tax consists of a 425 county sales t. Learn all about Nassau real estate tax. This is the total of state and county sales tax rates.

This is the total of state and county sales tax. This is the amount you pay to the state government based on the income you make as opposed to federal income tax that goes to the federal government. Rules of Procedure PDF Information for Property Owners.

The 2021 Nassau County property tax rate was 515 per 1000 of full market value plus. The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600. Assessment Challenge Forms Instructions.

Property Tax in Nassau MN 2021 Guide Rates Due Date Exemptions Calculator Records Codes. Nassau County FL The primary responsibility for the office of Property Appraiser is to produce a tax roll which is fair and equitable. Typically this means that people will pay an average of about 11232 per year just on their property taxes.

Kevin Lilly 9044917302. When I Nassau County Property Tax Rates. It is also linked to the Countys Geographic Information System GIS to provide.

The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County. That said 50 states income ta. The Department of Assessment is responsible for developing fair and equitable assessments for all residential and commercial properties in Nassau County on an annual basis.

The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales. Whether you are already a resident or just considering moving to East Nassau to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Nassau County Tax Lien Sale.

Nassau County has one of the highest median property taxes in the United States and is ranked 720th of the 3143 counties in order. The Nassau County sales tax rate is 425. Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863.

The exact property tax levied depends on the county in Florida the property is located in. Property Taxes In Nassau County Suffolk County September 14 2021 0444 PM. The Latest News in Nassau County Property Taxes - Maidenbaum Property Tax Reduction Group LLC.

While the 2 percent figure is well above the 156 percent increase provided for in 2021 its good news for Nassau County homeowners already struggling with some of the highest property tax rates in the US. This is the total of state and county sales tax rates. This tax cap applies to the Nassau County general tax levy which is a portion of all homeowners tax bills.

OFFICE OF THE NASSAU COUNTY PROPERTY APPRAISER. How to Challenge Your Assessment. Miami-Dade County collects the highest property tax in Florida levying an average of 102 of median home value yearly in property taxes while Dixie County has the lowest property tax in the state.

Choose a tax districtcity from the drop-down box selections include the taxing district number the name of the districtcity and the millage rate used for calculation Press the Submit button. About the Department of Assessment. Whether you are already a resident or just considering moving to Nassau to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

The Nassau County sales tax rate is 425. One of the most crucial tasks for a business own.

New York Property Tax Calculator 2020 Empire Center For Public Policy

How Parasites Poison Nyc Suburbs Property Tax System

Tax Preparer Resume Example Template Minimo Resume Examples Professional Resume Examples Job Resume Examples

Real Staging Tips Entryway In 2022 Florida Home Homeowner Staging

Property Taxes In Nassau County Suffolk County

Where Do Homeowners Pay The Most In Property Taxes The Washington Post

Homebuyer Sentiment Sinks To A 10 Year Low Amid Tight Supply Yahoo Finance Refinance Mortgage Real Estate Salesperson Mortgage

How High Are School Property Taxes On Long Island New York Mansion Global

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Suffolk County Ny Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Property Tax How To Calculate Local Considerations

New York Property Tax Calculator Smartasset

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

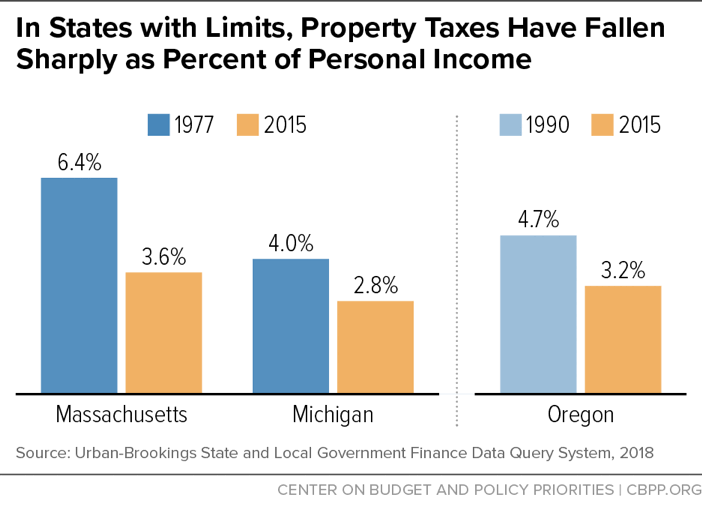

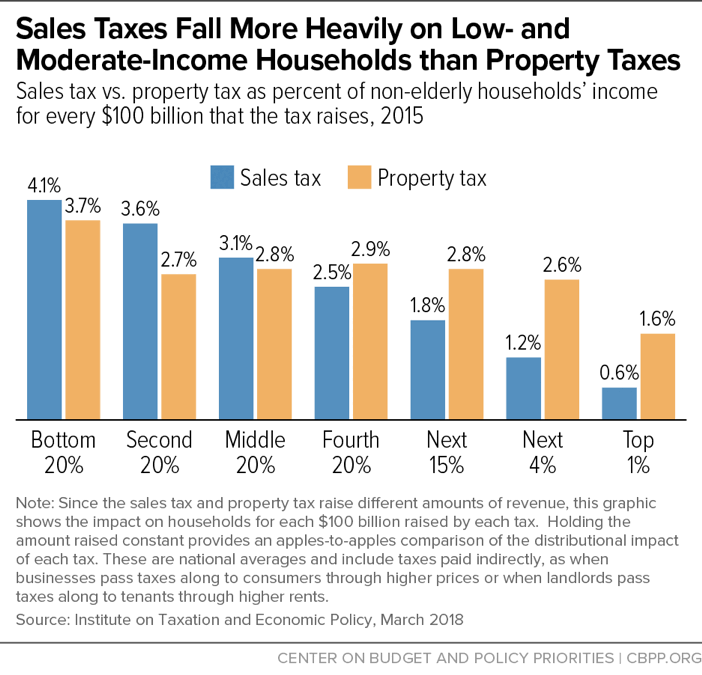

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Residents Pay The Lowest Property Taxes In These States

Nassau County Property Tax Reduction Tax Grievance Long Island